When a grants manager hears the term “grants management system,” they may picture a complicated, costly, technology-driven, data management system that requires an outside professional consultant to develop. This perception frequently leads to the employing entity to dismiss consideration, citing budget constraints. In truth, I have found that an effective grants management system can be a simple set of tasks or activities that help a grant manager understand administrative responsibilities, programmatic commitments, subaward/subrecipient management, expense monitoring, and overall performance tracking and reporting. Of course, there are other tasks and activities to consider, however, developing a firm understanding of these five systems has worked for me and my colleagues. Here, I will focus on simple systems that can be deployed without the cost of developing a technological solution.

Administrative Responsibilities

Understanding that administrative responsibilities start well before a grant is awarded, or even considered, is crucial. The entity must have the capacity to:

- perform general administrative tasks associated with reviewing opportunities;

- assist programmatic staff in developing effective project narratives, timelines, and budgets;

- meet the application requirements according to grant guidance documents;

- interact with grantors;

- communicate with stakeholders, including other business units within the entity; and

- ensure that an effective structure is setup in the entity’s accounting systems.

This is not an exhaustive list but should give a general understanding that there is a significant investment of time and effort associated with the administrative responsibilities required for a given grant. These activities can be managed using something as simple as a checklist that includes as many foreseeable tasks as possible.

As new tasks are identified, updating the checklist is essential to ensuring the next grant is sufficiently evaluated for capacity, as compared to performing the task and hoping to remember it the next time. To enhance the effectiveness of a checklist, it is helpful to identify the staff or functional area responsible for each item or section of the checklist. Doing so provides the broadest opportunity to assess an entity’s overall capacity and to weigh the cost of capacity against the value of a grant.

Example: If the most basic administrative capacity requirements total 240 staff hours, at an average of $30 per hour, the minimum capacity cost is $7,200. This does not include the cost for programmatic staff to perform implementation commitments. For a $20,000 grant, the administrative costs are 36% of the grant, excluding any applicable fringe benefits or indirect costs. Many grants allow a maximum of 10% administrative costs. In such a case, it is probably not in the entity’s best interest to pursue a $20,000 grant.

Programmatic Commitments

For this article, “programmatic or program” refer to the business unit or staff implementing the grant. With a few exceptions, there are most likely specific outputs and outcomes for which the program has made a commitment. Commitments, sometimes referred to as deliverables, are specified in a project narrative and/or work plan. There is an expectation that commitments or milestones will be completed within estimated time periods or not later than the end of the project period specified in the grant award. Developing a system for tracking commitment status and timelines can, again, be as simple as creating a checklist by converting the commitments from a narrative format to a line-item format, complete with due dates and a space for status notes.

Example: The commitment in a narrative format may be presented as: Through this grant, the energy costs will be lowered by an average of 20% for 45 disadvantaged homeowners in the first quarter of the grant’s project period through the purchase and installation of energy-efficient windows.

Converting the narrative into a measurable line-item format might be presented as: This grant will benefit 45 disadvantaged homeowners (output) to reduce household energy costs by an average of 20% through the purchase and installation of energy-efficient windows (outcome) in the first quarter of the project period (timeline).

For this example, the status at the end of the first quarter could be something to the effect of: 48 households benefited; average energy cost reduced by 27%, or 34 households benefited; average energy cost reduced by 17%; commitment delayed due to window supplier backorder.

Through this type of checklist, both updates make visible the progress for the commitment and are available in a single location for inclusion in any required performance reports to the grantor. The checklist will also play a role in the Performance Tracking and Reporting section discussed later.

Subaward/Subrecipient Management

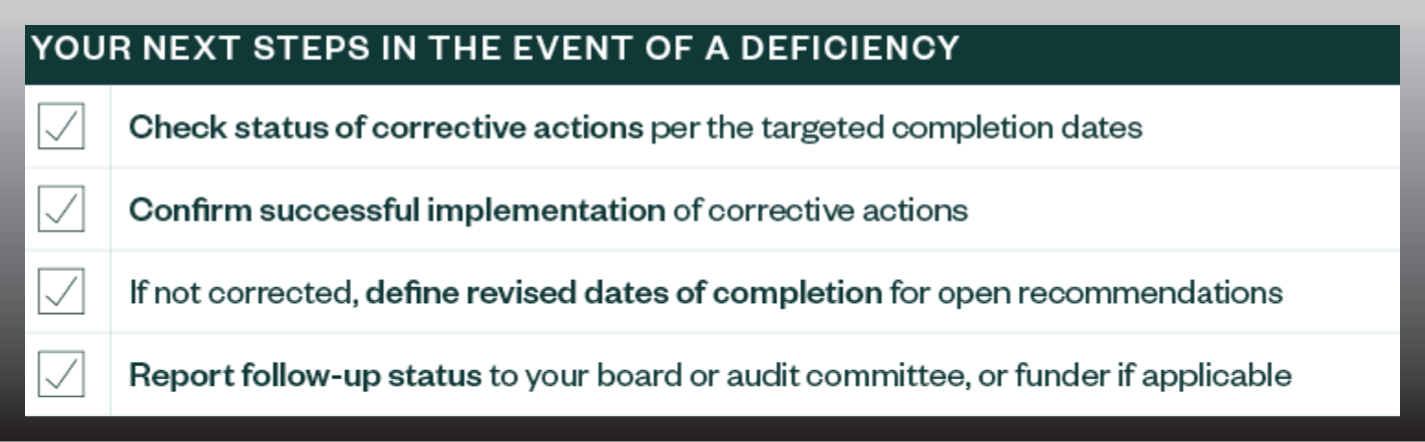

The systems discussed in this section are the result of identifying and addressing prior significant deficiencies. My organization had a lot of “hit and miss” attempts to develop a single solution over the past several years. A major lesson I learned is that you don’t know what you don’t know until you find out that you don’t know, and then you have no choice but to fix it. This has been the mantra that propelled my organization to prioritize the development of our current system, which addresses pre-award, subaward agreements, and post-award implementation of subawards.

By mirroring the typical grant cycle, we are able to capture activities that had often been skipped or performed in a less-than-effective manner. As with prior sections, the system can start with a simple checklist that includes the various activities and requirements. However, because of the complexity surrounding subawards and subrecipients, we engaged in a process-mapping exercise that starts from the moment the need for a subaward is identified through all of the steps leading up to the subrecipient receiving reimbursement for services rendered. The results of the mapping led to multiple systems for ensuring appropriate and compliant selection of subrecipients; standardized agreement templates that include all federal and/or other grantor requirements; standardized subrecipient budgets and reimbursement requests; standardized expense review and approval processes; standardized monitoring and risk assessment.

As mentioned earlier, each of these systems can be combined and used as a checklist, or they can be maintained as separate components to be used, depending on the phase of the subrecipient management cycle. The key takeaway here is that a system, even an imperfect system, will help a grant manager be successful. The more activities and tasks that are captured in and through the system, in addition to the consistent standardized manner in which an organization adheres to the system, is paramount.

Expense Monitoring

While it may seem intuitive, revenue and expenses associated with a grant should be tracked separately from the entity’s other sources of revenue and expenses in a financial management or accounting system. However, that may not always be the case. A successful grants manager will ensure that each grant is uniquely identifiable and trackable.

My organization has a robust financial system that prevents comingling grant funds with other funding sources, including other grant sources. However, that alone does not always provide the information needed to ensure appropriate monitoring. Financial accounting often captures the what, the who, and the amount associated with an expense; however, it rarely captures the why. This is where an additional system becomes necessary.

Two of the more effective and efficient systems used in day-to-day expense monitoring are what we refer to as a tracking tool and a standardized expense review process. Each grant has its own standard tracking tool that serves the purpose of capturing the data that will help assemble both financial and performance reports. The tracking tool is set up to be in alignment and make visible the original budget as approved in the grant award, as well as tracking the actual expenses incurred in each cost category. An observation prior to implementing the tracking tool was that when a grant was awarded and the budget established, there was little attention paid to actual expense allocations occurring during a given performance reporting period. This led to significant rework, expense transfers, and requests to the grantor to reallocate the budget, with no guarantee that the request would be approved. This opened our organization to substantial financial risk and the likelihood of noncompliance. The tracking tool functions as an early warning system if spending drifts unexpectedly.

The system used for standardized expense review applies to all grant expenses as well as subrecipient reimbursements. The system is similar in nature to a checklist, but is arranged according to the role each responsible party has in the process. This system was developed in response to an internal audit observation showing inconsistent expense review and approval processes among programs. A deeper audit revealed that the inconsistency frequently led to missing steps and authorized approvals, leading to rework and disqualification of expenses lacking sufficient supporting documentation. The system includes steps that the program must perform, including confirming that the expense is in alignment with the grant parameters and adheres to the basic cost principles of being necessary, reasonable, and allocable. The program must also ensure that appropriate supporting documentation is included, such as detailed invoices and performance reports, when applicable. The grant manager confirms the information and ensures appropriate program approvals are in place and adds it to the tracking tool before forwarding the request to Accounts Payable, where additional standard steps have been assigned for the person processing the transaction. This system has corrected the deficiencies through standardization, which includes clearly communicated roles and responsibilities.

Performance Tracking and Reporting

Performance reporting requirements are a primary expectation included in nearly all grant awards. The majority of grantors want to confirm that the program is implementing the grant according to the award and its related terms and conditions on schedule and within budget. Financial systems and the tracking system described in the Expense Monitoring section are sources for responding to the financial performance of implementing the grant. Having a system to track commitment performance is equally essential to the success of a grants manager. An effective grants manager will confirm that the reporting expectations are included in the checklist described in the Programmatic Commitments section. As mentioned earlier, the checklist makes visible the commitments and progress. The visibility ensures an additional level of accountability to the program.

The checklist’s visibility can help a grants manager compile additional performance metrics to be provided to the entity’s internal leadership, even if it is not a grant reporting requirement. An example of metrics of interest to my organization’s leadership include the percentage of commitments completed relative to the total commitments, the percentage of commitments completed within the established timelines, and the actual outputs and outcomes versus the estimated outputs and outcomes.

Example: Five completed commitments out of 25 total commitments is 20%. Of those five, three were completed within the timeline, or 60% on time. One of the commitments completed on time estimated that 45 households would benefit from the commitment (output) to provide disadvantaged homeowners with energy-efficient windows to reduce household energy costs by 20% or more (outcome). However, the actual number of homeowners receiving assistance was 49 and the average cost savings was 27% per household. This means that the commitment served 8.8% more homeowners and the savings were 35% higher than expected. These four performance metrics serve to show that the program is progressing through the completion of commitments but is missing the time commitments 40% of the time. The entity leadership or grants manager may want to know why there are delays and what can be done to help the program achieve its goals. If this information is presented in the grantor reports, it is highly likely that the grantor will be pleased to see that their assistance provided an even greater benefit than expected, even if it took longer than estimated. Most of all, this information can be easily captured through the checklist at any given point in time.

In addition to the benefits of the checklist, establishing a reporting calendar for the grant that triggers reminders to responsible parties helps to manage adherence to the grant requirements. A component of the reporting system I have found works for me is adding key internal dates on my calendar as a meeting to which I invite the responsible program staff. This serves as an effective “check-in” with the program and confirms report due dates.

In conclusion, having strong, consistent grants management systems in place, no matter how simple or complex, will help a grants manager be more successful in performing day-to-day activities. Continuous improvement to those systems, clearly defined roles, frequent communication, visibility, and leadership support increase efficiency and reduce the likelihood for audit findings or redundancy in effort. Standard work processes are essential. When multiple parties are performing grants management functions in silos with different processes and procedures, it will (not might) lead to problems that are often costly and time-consuming to remedy.

Robyne Clark, CGMS is a grants manager with the Arizona Department of Environmental Quality. Her favorite part of grants management is helping the recipient program staff who are applying for and/or implementing a grant navigate through the processes. She has been a Certified Grants Management Specialist (CGMS) since 2019.