Eligibility

As established earlier in the Interim Final Rule, your organization has a lot of flexibility in how you choose to allocate your awarded SLFRF funds, so long as the expenditures fall under these four (4) categories:

- To respond to the COVID-19 public health emergency or its negative economic impacts;

- To respond to workers performing essential work during the COVID-19 public health emergency by providing premium pay to such eligible workers of the recipient, or by providing grants to eligible employers that have eligible workers who performed essential work;

- For the provision of government services, to the extent of the reduction in revenue of such recipient due to the COVID–19 public health emergency, relative to revenues collected in the most recent full fiscal year of the recipient prior to the emergency;

- To make necessary investments in water, sewer, or broadband infrastructure.

The Interim Final Rule is also where you can find definitions and clarifications that can further help you establish if your expenditure is eligible. You can also refer to the Assistance Listing for the SLFRF listing on SAM.gov (formerly known as CFDA Number, 21.027) for more information.

As a recipient of a SLFRF award, you may use the funds to cover eligible costs incurred between March 3, 2021 and December 31, 2024, as long as the funds for those obligations are expended by December 31, 2026.

You will need to maintain procedures for obtaining information evidencing, including a valid SAM.gov registration, eligibility for your organization, your subrecipients, and potential contractors as well.

Implementing risk-based due diligence for eligibility determinations is a best practice to augment your organization’s existing practices. There is also a greater emphasis on pre-award risk assessment in the guidance than we have seen with other funds.

Reporting

All recipients of Federal funds must complete financial, performance, and compliance reporting as required and outlined in Part 2 of the SLFRF guidance. SLFRF awards are generally subject to the requirements in the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, 2 CFR Part 200 (UGG). The new guidance provides a general summary of compliance responsibilities, and all awardees are encouraged to also review the 2020 OMB Compliance Supplement Part 3. Compliance Requirements (issued August 18, 2020).

The guidance does not change the reporting or compliance requirements pertaining to the CRF. The reporting requirements for SLFRF where changes from CRF requirements have occurred include:

- Project, Expenditure, and Subaward Reporting: The data elements for the Project and Expenditure Report will largely mirror those used for CRF, with some minor exceptions noted in the guidance. The users’ guide describes how reporting for CRF funds will relate to reporting for the SLFRF program.

- Timing of Reports: CRF reports were due within 10 days of each calendar quarter. SLFRF quarterly reporting will be due 30 days from quarter end.

- Program and Performance Reporting: The CRF reporting did not include any program or performance reporting, which is now required for SLFRF funds.

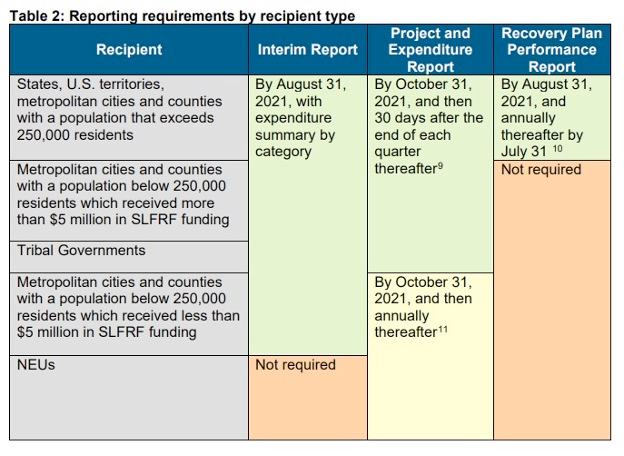

There are now three (3) types of reporting requirements for SLFRF program funds: the Interim Report (Section A, page 13), the Project and Expenditure Report (Section B, page 15), and the Recovery Plan Performance Report (Section C, page 23). We have taken a deeper dive into these reporting types and have created a guide to the Reporting Requirements for the Treasury’s SLFRF.

The following table describes new reporting requirements by recipient type: